- سبدخرید خالی است.

- ادامه خرید

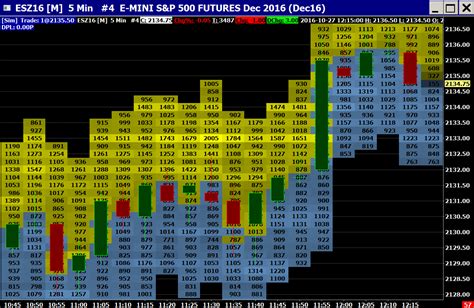

Market Depth: What It Reveals About Supply And Demand

Unlocking the Secrets of Cryptocurrency: Market Depth And Its Role in Supply and Demand

The World of Cryptocurrencies Has Been A Realm of High Volatility and Rapid Price Movements for Quite Some Time. One aspect that has garnered significantly Attention from Investors, Traders, and Economists Alike is the concept of market depth. In this article, we’ll delve into what market depth reveals about supply and demand in the cryptocurrency market.

What is Market Depth?

Market Depth refers to the number of buy and sell orders present on a cryptocurrency exchange or trading platform. It’s a crucial metric that helps traders gauge the liquidity and volatility of a particular asset. In Other Words, it Measures How many different types of trades are Being Executed in Relation to a Specific Cryptocurrency.

What does Market Depth Reveal About Supply and Demand?

Market Depth Has Several Implications when it comes to supply and demand dynamics:

- Liquuidity : A HIGHER Market DEPTH Indicates More Liquuidity, which Means There’s More Buying and Selling Activity. This can lead to lower prices for assets with low market depth, as there are fairers competers competing for a limited number of buyers.

- Volatility : Conversely, Lower Market Depths can result in Higher Volatility, as Fewer Traders are participating in the market. When there’s less trading volume, prices tend to fluctuate More Rapidly.

- Supply and Demand Imbalance : A High Market Depth Suggests That the Supply Side (New Investors) is outpacing the demand Side (Existing Holders). This imbalance can drive prices upward, as buyers are willing to pay a premium for assets with low market depth.

- Bullish vs. Bearish Sentiments : Market Depth Can also Reveal the Prevailing Bullish or Bearish sentiment in the Cryptocurrency Market. A HIGER VOLUME OF BUY Orders and Lower Sell Orders May Indicate That Investors Are Optimistic About An Asset’s Potential for Growth.

Example: Bitcoin (BTC)

Let’s Take Bitcoin as an Example to Illustrate How Market Depth Reveals Supply and Demand Dynamics. In 2020, Duration A Period of High Market Volatility, The Market Depth of BTC Decreased Significantly From Around 5,000 Buy Orders per second in January 2019 to Just about 100 Buy Orders per second in December 2020.

This decrease in Market Depth Coincided with an increase in Price from around $ 4000 to over $ 50,000. The Drop in Market Depth and Corresponding Increase in Price Suggest That the Supply Side (New Investors) was outpacing the demand Side (Existing Holders). This led to a surge in Buying Pressure, Driving Prices Higher.

Conclusion

Market Depth is an essential Metric for Understanding Supply and Demand Dynamics in the Cryptocurrency Market. By Analyzing Market Depth, Traders Can Gain Valuable Insights Into The Liquuidity, Volatility, and Sentiment of Various Cryptocurrencies. While Market Depth Provides a Useful Gauge of the Market’s Overall Health, It Should not be Relied Upon As The Sole Indicator of Future Price Movements.

As With Any Investment Strategy, It’s Essential to Consider Multiple Factors When Making Decisions In The Cryptocurrency Market. By Combining Market Depth Analysis with Fundamental Research and Technical Analysis, Traders Can Make More Informed Decisions and Navigate the Complex Waters of the Crypto Markets with Greater Confidence.