- سبدخرید خالی است.

- ادامه خرید

Price Action Trading: A Guide For Cryptocurrency Traders

Cryptocurrency Price Action Trading: A Guide for Cryptocurrency Traders

The world of cryptocurrency trading has exploded in recent years, with prices fluctuating rapidly and unpredictably. As a result, traders are constantly on the lookout for effective strategies to navigate this fast-paced market. One popular approach is price action trading, which involves using technical analysis techniques to identify patterns and trends in cryptocurrency prices.

What is Price Action Trading?

Price action trading is an informal term used to describe the process of analyzing cryptocurrency prices using historical data and technical indicators. It’s a more nuanced approach than traditional chart-based trading, as it takes into account the actual price movements of individual cryptocurrencies rather than relying solely on price charts.

Key Concepts in Cryptocurrency Price Action Trading:

- Time Frame: Cryptocurrency traders often focus on shorter time frames, such as 4-hour or 1-hour charts, to identify quick-moving patterns and trends.

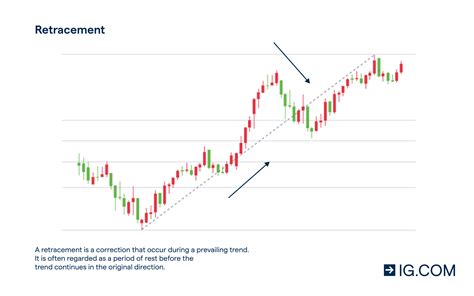

- Support and Resistance: Price action traders look for areas of support (where prices tend to bounce back) and resistance (where prices tend to pull back), which can indicate potential price reversals or continuations.

- Trend Lines and Channels: Traders use trend lines, channels, and other technical indicators to identify the overall direction and momentum of a market.

- Bollinger Bands: This indicator helps traders gauge volatility and predict price movements by expanding or narrowing bands around the average price.

Common Price Action Trading Strategies:

- Range Breakout: A trader buys the low of the breakout range (a narrow band) when the price breaks out above it, expecting a potential reversal.

- Trend Following: Traders buy a cryptocurrency only when it’s trading above its 20-period moving average and below its short-term trend line.

- Breakout Trading: A trader buys or sells a cryptocurrency at a certain price level, hoping to profit from the difference between the two prices.

Popular Cryptocurrency Markets for Price Action Trading:

- Bitcoin (BTC): The most widely traded cryptocurrency, with a large and active market.

- Ethereum (ETH): A popular altcoin with a strong presence in the market.

- Litecoin (LTC):

Known for its fast transaction speeds and low fees.

Tips for Successful Price Action Trading:

- Practice Before Trading: Before attempting to trade any cryptocurrency, it’s essential to practice using historical data and technical indicators on a backtesting platform or paper trading account.

- Stay Disciplined: Price action trading requires discipline and patience. Avoid impulsive decisions based on emotions, and stick to your strategy.

- Continuously Learn: The cryptocurrency market is constantly evolving. Stay up-to-date with the latest trends and technical analysis techniques to improve your skills.

Conclusion:

Cryptocurrency price action trading offers a unique opportunity for traders to gain insights into the underlying markets and make informed decisions. By understanding the key concepts, strategies, and markets used in this approach, cryptocurrency traders can improve their skills and achieve greater success in the world of digital assets.

Recommended Reading:

- “Technical Analysis of the Financial Markets” by John J. Murphy

- “Cryptocurrency Trading with Technical Analysis” by Peter N. Tsai

- “The Trading Bible” by Mark Douglas

Disclaimer: This article is for informational purposes only and should not be considered as investment advice. Cryptocurrency trading carries significant risks, including price fluctuations, market volatility, and potential losses. Always do your own research and consult with a financial advisor before making any investment decisions.