- سبدخرید خالی است.

- ادامه خرید

EVM, OKX, Order Book

“Order Book Explained for Cryptocurrency Enthusiasts: A Beginner’s Guide to Understanding the Basics of Crypto Trading with EVM and OKX”

In the world of cryptocurrency trading, understanding the inner workings of different platforms is crucial for making informed decisions about buying, selling, and investing in these digital assets. Two essential components that are often overlooked but play a vital role in any successful trading experience are the order book and the Ethereum Virtual Machine (EVM).

What is an Order Book?

An order book is a centralized platform where buyers and sellers interact to trade cryptocurrencies. It’s essentially a list of all available orders, including buy and sell requests from both parties. The order book allows for efficient matching of buyers and sellers, ensuring that trades are executed quickly and at fair prices.

A typical order book consists of two lists:

- Buyer’s List

: This is where the buyer submits their offer to purchase a particular cryptocurrency.

- Seller’s List: This is where the seller submits their counteroffer to sell a specific cryptocurrency.

What is EVM?

The Ethereum Virtual Machine (EVM) is a decentralized, open-source platform that runs on top of the Ethereum blockchain. It provides a virtual environment for executing smart contracts and decentralized applications (dApps). The EVM is responsible for verifying transactions, validating blocks, and managing the security of the network.

In simpler terms, the EVM allows developers to create and deploy their own applications, such as decentralized finance (DeFi) protocols, games, or social media platforms, without the need for a central authority. This autonomy is made possible by the EVM’s ability to execute transactions and manage state changes on the blockchain.

LINK: A Leading Crypto Exchange

For those interested in trading cryptocurrencies, OKX is an excellent platform to consider. Founded in 2017, OKX has established itself as one of the largest and most reputable cryptocurrency exchanges in the world. With a wide range of trading pairs, competitive fees, and advanced features like leverage and margin trading, OKX provides a solid foundation for traders looking to explore various cryptocurrencies.

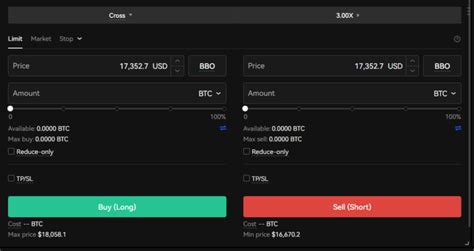

Order Book at OKX: How it Works

OKX’s order book is designed to provide fast and reliable trade execution. The platform uses a hybrid model that combines the benefits of centralized and decentralized exchanges (CEXs). Here’s how it works:

- Buyers submit orders: When you place an order on OKX, your order is listed in the buyer’s list.

- Sellers respond with offers: Sellers can view your order on their side and respond with an offer to buy or sell a specific cryptocurrency.

- Matched trades are executed: The matching process happens automatically, ensuring that buyers and sellers trade at fair prices.

Conclusion

In conclusion, understanding the basics of crypto trading and EVMs is essential for making informed decisions about investing in cryptocurrencies like Bitcoin, Ethereum, and others. By grasping how order books work and what an EVM does, you’ll be better equipped to navigate the world of cryptocurrency trading and maximize your returns.

At OKX, as a leading crypto exchange, we strive to provide a seamless and secure experience for our users. We hope this article has provided valuable insights into the world of crypto trading, order books, and the EVM. Happy trading!