- سبدخرید خالی است.

- ادامه خرید

Cryptocurrency and Taxation: How to Minimize Your Liability

Cryptocurrency and Taxes: How to Minimize Your Liability

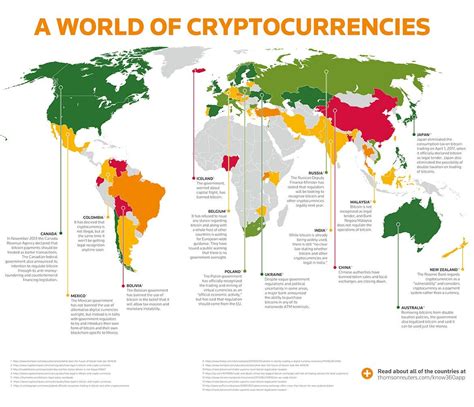

The rise of cryptocurrencies has brought with it a new wave of tax concerns. With the rise in the use of digital currencies like Bitcoin, Ethereum, and others, governments around the world are grappling with how to regulate and tax these assets. As a result, those who own or invest in cryptocurrencies may be subject to a variety of taxes and penalties.

In this article, we’ll look at the key aspects of cryptocurrency taxation and provide tips on how to minimize your liability.

What’s Taxable?

Cryptocurrencies are considered property for tax purposes in many jurisdictions. This means that gains from buying, selling, or holding cryptocurrencies may be subject to capital gains tax. The tax implications vary by jurisdiction, but here are some general guidelines:

- Capital Gains Tax: In most countries, capital gains are taxed as ordinary income when earned. For example, if you bought Bitcoin for $1,000 and sold it for $5,000, you would be subject to capital gains tax at a rate of 20% on the profit.

- Taxation by type of transaction: Cryptocurrency transactions can be divided into two categories:

+

Volatility:

If the value of your cryptocurrency is highly volatile, such as during market fluctuations, it may be considered “ordinary” income and taxed accordingly. This means that if you bought a particular cryptocurrency for $1,000 and sold it for $5,000, you would be subject to capital gains tax on the profit.

+

Liquidity: If you store your cryptocurrency in a secure wallet or exchange account that provides liquidity through trading, lending, or borrowing, you may not face significant capital gains tax consequences.

Tax Planning Strategies

To minimize your liability and avoid tax consequences, consider the following tax planning strategies:

- Diversification: Spread your investments across multiple cryptocurrencies to reduce your overall risk.

- Holding Periods: Hold your cryptocurrency for a longer period of time to take advantage of lower capital gains taxes.

- Liquidity Management: Maintain enough liquidity in your portfolio or exchange account so that you can sell your cryptocurrency at a favorable price.

- Tax-Deferred Accounts: Consider using tax-deferred accounts, such as 401(k)s or IRAs, if available, to hold and manage your cryptocurrency portfolio.

- Holding Periods for Tax Purposes: If you plan to convert or liquidate your cryptocurrency holdings, consider holding them for at least a year to take advantage of lower capital gains taxes.

Tax Obligations

To meet your tax obligations, it is essential to maintain accurate records and statements regarding your cryptocurrency transactions. This includes:

- Proof of Purchase: Keep receipts and invoices for your purchases.

- Recordkeeping:

Keep detailed records of your transactions, including fees and exchange rates.

- Annual Tax Returns: File annual tax returns with the appropriate authorities, providing supporting documentation.

Penalties for Non-Compliance

Failure to comply with tax regulations can result in significant penalties. Please note that:

- Late Tax Filing Penalties: Failure to file tax returns on time may result in late filing penalties.

- Underreporting Income: Underreporting income or overstating deductions may result in penalties and fines.

Conclusion

Cryptocurrency taxation is a complex topic, but with proper planning and compliance, you can minimize your liability and avoid significant penalties. By understanding the key aspects of cryptocurrency taxation and implementing effective tax strategies, you can protect yourself from potential tax consequences.

Please note that this article is for informational purposes only and should not be considered professional advice.