- سبدخرید خالی است.

- ادامه خرید

The Importance Of Risk Management In Trading Ethereum Classic (ETC)

The importance of risk management in the classical trade in Ethereum (etc.)

In the world of digital assets, cryptocurrencies, such as Ethereum Classic (etc), have gained significant investment attention and capabilities. However, trade, etc., like any other resource, is associated with an inseparable risk that merchants should take into account to minimize losses and maximize profits. Risk management is one of the key aspects of risk management in cryptocurrency trade.

What is risk management?

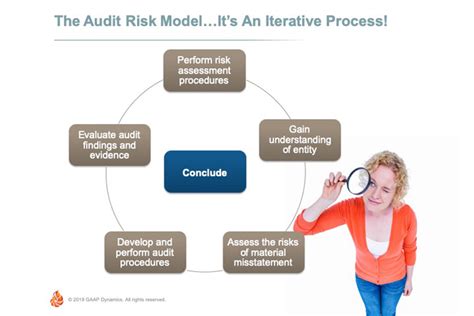

Risk management refers to the process of identifying possible sources of loss or damage and steps to relieve these losses through various strategies. In the context of cryptocurrency trade, risk management includes the understanding of the risk associated with purchase and sales, etc., such as market variability, price fluctuations and regulatory changes.

Why is risk management important in trade in Ethereum Classic?

Etc. has been experiencing significant market fluctuations for years, which can cause significant losses for merchants who do not have adequate risk management strategies. Some of the reasons why risk management is crucial in commerce, etc., include:

- Market variability : The price, etc. It can be very unstable, and prices change rapidly due to market moods and regulatory changes.

- Price fluctuations : The price, etc., may fall significantly, which will cause significant losses if they are not adequately administered.

- Regulatory changes : Changes in regulatory environments can affect the value of etc, which makes the risk management strategy adequate and adapted.

Types of Risk Management Strategy for Ethereum Classic

To effectively manage the risk during trade, etc., merchants must use several strategies, including:

- Position size : position management to limit potential losses.

- Orders to stop : Establish detention orders to lower the article automatically when it reaches a certain price.

- Coverage : Use of derivatives or other instruments to relieve potential losses.

- Diversification : Dissemination of investments in many assets to reduce exposure to risk.

best risk management practices in trade, etc.

To guarantee optimal performance and minimize risk, merchants must follow best practices, such as:

1.

2.

3.

- Commercial performance monitoring

: Continuous monitoring of commercial results to identify possible problems or risks.

Application

Risk management is a key aspect of cryptocurrency trade, especially when invested in assets such as Ethereum Classic (etc.). By using effective risk management strategies and observing best practices, merchants can minimize losses and maximize profits. As market evolutions, etc., it is necessary for merchants to be informed and adapt the risk management strategies.

Recommendations

For merchants who want to start or improve their risk management skills in the classical trade in Ethereum:

- Take an online course

: Consider registering in a course that includes risk management strategies in cryptocurrency trade.

2.

3.

Risk management is a priority, merchants can move around the complex world of cryptocurrency trade and achieve their financial objectives.