- سبدخرید خالی است.

- ادامه خرید

Fundamental Analysis: Evaluating Crypto Assets For Investment

Cryptocurrency: Basic Analysis: Evaluation of Krypto Assets for Investment

The World of Cryptocurrency Has Gained Considerable Attention in Recent Years, and the Market Has Experienced Unprecedented Growth and Volatility. As a New Investor, Navigation of the Complex and Rapidly Developing Landscape Can Be A Challenge. In this article, we are immersed in the basic analysis of popular cryptocurrencies, thoroughly examining their thoroughly, weaknesses and investment potential.

What is cryptocurrency?

The Cryptocurrency is a digital or virtual currency that uses cryptography for security and is not controlled by a single government or financial institution. The first cryptocurrency to be created was Bitcoin, which was launched in 2009 with a pseudonym satoshi nakamoto.

Why Invest in Cryptocurrencies?

Investing in cryptocurrencies sacrifices Many Possible Benefits:

- Great Return Potential : the prices of the cryptocurrency were historically very volatile and significant profits are possible duration the rapid price increase.

- Decentralized and Democratized finances : Cryptocurrencies Allow Peer-to-Peer Transactions to Mediators, Promote Financial Inclusion and Democratization to Market Access.

- Limited Care : Most cryptocurrencies have limited care that can Help Maintain Value over time.

Overview of Cryptocurrency Market

The Cryptocurrency Market is very fragmented, with many tools available, each with unique features. Some Popular Cryptocurrency Are As Follows:

- Bitcoin (BTC) : The Largest and Most Widely Recognized Cryptocurrency, With Market Capitalization More than More Trillion Dollars.

- Ethereum (ETH)

: Decentralized Platform for Creating Smart Contracts and Decentralized Applications (Dapps).

- Ripple (XRP) : A Fast and Cheap Payment Network That Allows Cross -Border Transactions.

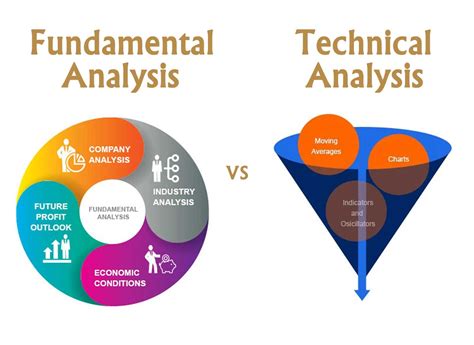

Basic Analysis

When evaluating cryptocurrencies, IT is essential to take into account the following basic factors:

1

Price : The Current Market Price of the cryptocurrency is only one aspect of its value.

- Supply and Demand : The Balance Between Buyers and Sellers Can Affect Prices.

- Development Team and Schedule : A Strong Development Team with a Clean Schedule can Contribute to growth and stability.

- Technology and Security

: Advanced Technology and Robust Safety Measures Are Key to Mintining user Confidence.

- Regulatory Environment : Changes in Regulations Can Significantly Influence the Market.

Bitcoin (BTC) Basic Analysis

Bitcoin is of regarded as a gold standard for cryptocurrencies, with a strong reputation of security and decentralization. Here are some key essential factors:

1

price: The Current Price of BTC is about $ 30,000.

- Supply and Demand : Bitcoin’s Total Supply is Limited to 21 Million, While Demand Remains High Because of its ScarCity and Limited Acceptance.

- Development Team and Schedule : The Development Group Beitcoin was LED by Satoshi Nakamoto, Who Created the Original Protocol.

- Technology and Security : Bitcoin Underlying Technology has a decentralized, Safe and Strong Reputation for Scalability.

Ethereum (ETH) Basic Analysis

Ethereum is The Largest Cryptocurrency with Market Capitalization, Focusing Strongly On Smart Contracts and Decentralized Applications (Dapps). Here are some key essential factors:

1

price: The Current Price of ETH is about $ 3,000.

- Supply and Demand : Ethereum’s Total Supply is 18 Billion, While Demand Remains High Due to Scalability and Opportunities for Developers.

- Development Team and Schedule : The Development Group Behind Ethereum Includes Remarkable Persons Such As Vitalik Buterin and Anthony Di Iorio.

4.