- سبدخرید خالی است.

- ادامه خرید

Understanding The Risks Of NEO (NEO) And Market Takers

Understand the risks of Neo (NEO) and market takers

The cryptocurrency world has been more and more among recents, Manny seeking to capitalize on the rapid potential. On the largest poptocurrencs is Neo (NEO), a decentralized platform which allows certain types of sales, aquatic. In this article, we will dive into the dissociated with Neo and market takers, and explore, they can be left for investors.

What is Neo?

Neo is an open source and decentralized blockchain platform which allows the selling of Sove Digits in the form of tokens, smart transractors and smart applications (DAPPS). The project was available in 2014 by Yihan Guo and Dr. Wang Xing, two Chinese Entrears who envied a more efficient and safer to facilitate international trade and trade.

Risks associated with Neo

As with any investment, there is an is associated with investment in Neo. Some of the key risks include:

* Volatility of the market : The price of Neo can fluctuate due to the brands of Varis, Soch as changes in the chainges of investors and regulations. press releases.

* Regulatory risks : NEO operates in a relatively unexploited space and the regulation of disks exist if the projection of correctly. A faux pone of synchronization can be legitified for investors.

* Security risks : As with any cryptocurrency, NEO users must be vigilant.

Risks of intelligent contraction **: NEO’s intelligent contraction platform allows your cash contracts which can, develop the assets of the blockchain. Howver, if they are current or updated regularly, they can set up significant security.

Market takers *

Amarket Maker is a type of investor that takes the two years of an asset label, buying and selling at the same time. In the case of NEO, market manufacturers can be part of the bear for investors to the price handling capacity, in particular: including: including:

* Sizing of the POSSION : Market Kakers of HVE The position in Neo, there is a free iStors tors toooles. trigger of margin calls.

Market influence *: With significant capital at stake, market manufacturers can exert a substantial influence on the life of Lifemores, result.

The lever and the amplifation lever *: Market Kakers of the lever effect to amplify the position, it is for quickly and decreases.

Example: the overvoltage of 2017 prices from Neo *

In September 2017, NEO experienced a remarkable sub-specialty of the position of the post of the project post. While investors are talking about the future of the neo, the brand is increasingly earning a fluctuation price of $ 1 and $ 30 per room.

This explosion price is a signature of the increase in neo, you use in the theater. Consequently, many innocent investors have been caught off guard, undergoing significant losses as a trail brand.

Conclusion*

While the NEO is an intriguing cryptocurrency with growth potential, it is essential to understand market takers and speaking investors must be cautious to enter or get out of the market, because handling of the brake, ampliation of the location and the volatility of prices can be significant.

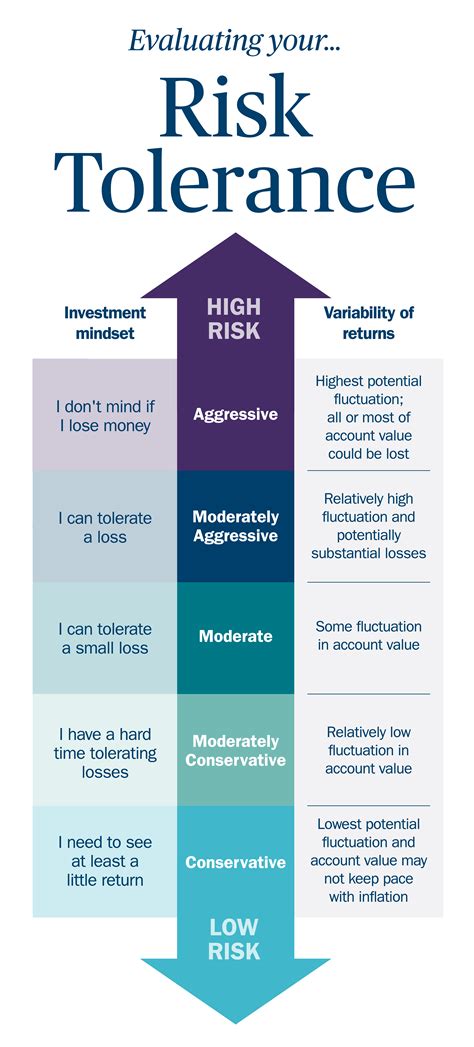

As Lways, a metififi in the investment strategy is to manage. Investors assess their investment objectives, their rice tolerance and their market analysis in investment in investment in NEO or everything.

Non-responsibility clause *

This article is not investment advice.