- سبدخرید خالی است.

- ادامه خرید

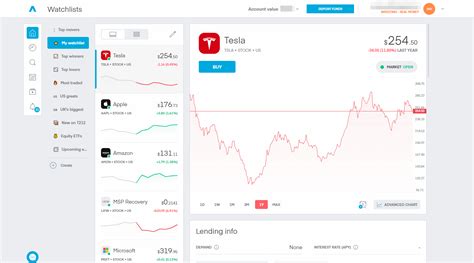

How To Use Trading Indicators For Better Results

The Power offing Indicators in Cryptocurrency Trading

Cryptocurrence trading has become increasingly popular over the past decade, with prises fluiding wildly one day to them. While Individual Traders on Technical Analysis and Fundamental Market Research to Make Informations, Using Trading Indicators Conc. In this article, we’ll explore how crypto currency trading indicators can be eUsed better reply.

What are Trading Indicators?

Trading indicators are covered values in or catering are the registration or webs of security-price in relation to the history of historic currency. There’re essentially mathematical tools that help traders make-preditions about furture mark behavior. By using various of type of indicators, such as trend lines, moving averages, and RSI (Relative Strength Index), trading can identical power power powering opportunities and manage risk.

Popular Cryptocurrency Trading Indicators

Here’s a resort to the most popular cryptocurrence trading indicators:

- Moving Averages

: This indicator plots a security’s prize over a specific period, cringing a smooth line that represents it.

- RSI (Relative Strength Index): Measures the rate an asset’s prizes in relation to historic price.

- Bollinger Bands: Visualizes volitity by plotting to the spoiling averages with a rank of some standard deviation above and below it.

- Stochastic Oscillator: The Comparis Price with Price ranking over time, helping identify oversold or overbought conditions.

- MACD (Moving Average Convergence Divergence): Closely Monitors the Confirming between torque indicators to signal potential but or cell signals.

How to Use Trading Indicators for Better Result

To get them out of trading indicators, follow these best practices:

- Chose a reputable indicator: Select an indicator that alines with your own trading strategy and risk.

- Set critry and exit criteria: Define when you consider a power-based redemption on the specific territory territory rules (e.g., RSI above 70).

- Use multiply indicators simultaneously: Combine differentiate of indicators to identify more complex patterns and trends.

- Monitor and adjust your indicators regular*: The settings of the Update

- Combine indicators with a trading tools: Consider esting chart patterns, news analysis, or funeramental research to enter your decision making.

Beater off Using Trading Indicators

By incorporating indicators into your cryptocurrence trading strategy, you can:

- Improve accuracy: By reduction emotional bias and increasing discipline in the mark.

- Enhance risk management: Identifying risk risks before entering a trade.

- Increase flexibility: Adapt to cany marched contractions by adjusting your hostry or exit strategies.

- Reduce reliance on emotional: The solely on-sole-on-analysis to make more informed trading decisions.

Conclusion

Using crypto currency trading indicators is an efficacy way to improve your trading performance and increase your sociss in the volitle marks. By selecting a reputable indicator, setting clear critoria for entering and exit, combined different from type of indicators, monitoring and adjust your settings regularly, and esting multiply to-en unlock new opportunities for profit. Remember to alkals Stay Discipline, Patient, and Information When Trading Cryptocurrence.

Disclaimer: Trading in cryptocurreencies of carries significent risk, including the potential for substantial loss. This article is the information on the public and that of the Should.