- سبدخرید خالی است.

- ادامه خرید

Analyzing Market Sentiment: AI’s Role in Crypto Trading Success

Market Sentiment Analysis: The Role of AI in Cryptocurrency Trading Success

The world of cryptocurrencies has experienced tremendous growth and volatility over the past decade. With the rise of blockchain technology, decentralized finance (DeFi), and artificial intelligence (AI) tools, investors have more options than ever to invest their money. However, navigating the complex and often unpredictable market can be a daunting task even for seasoned traders.

In this article, we will analyze how the role of AI in cryptocurrency trading has evolved, highlighting its potential benefits and areas for improvement.

The Rise of AI in Cryptocurrency Trading

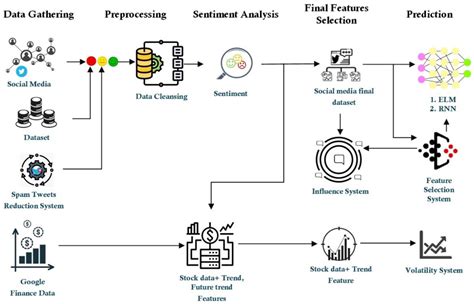

AI-based trading platforms have been gaining popularity in recent years. These tools use machine learning algorithms to analyze market data, identify patterns, and predict future price movements. Here are some notable examples:

- Binance AI-powered trading platform: Binance, a popular cryptocurrency exchange, introduced an AI-powered trading platform in 2019. The feature uses natural language processing (NLP) and machine learning to analyze market data and generate buy and sell signals.

- Coinigy: Coinigy is a comprehensive platform offering AI-powered trading insights, including risk management tools, technical analysis, and portfolio optimization.

How AI Helps You Succeed in Crypto Trading

The role of AI in cryptocurrency trading has been extensively studied, and its benefits are clear:

- Improved market timing: AI algorithms can analyze massive amounts of market data in real time, identifying patterns and trends that may have gone unnoticed by human traders.

- Improved Risk Management: By analyzing market sentiment and identifying potential risks, AI-powered platforms can help traders set more effective stop-loss orders and minimize losses.

- Increased Efficiency: AI-powered trading tools can automate routine tasks, freeing up traders’ time to focus on high-level decision-making and strategy development.

Challenges and Limitations

While AI has made significant progress in cryptocurrency trading, there are still several challenges to overcome:

- Data Quality: The vast amount of market data available today can be overwhelming, making it difficult to identify meaningful patterns.

- Training Data Trends: If training data is biased or incomplete, the resulting models may not perform well in real-world scenarios.

- Complexity and Interoperability: Cryptocurrency markets are highly complex, with multiple exchanges, wallets, and APIs competing for market attention.

The Future of AI in Cryptocurrency Trading

As AI technology advances, we can expect to see the emergence of even more sophisticated trading tools:

- Multi-Asset Integration: AI-based platforms will integrate multiple asset classes, allowing traders to analyze and invest in multiple cryptocurrencies.

- Real-Time Analytics: Advanced analytics will become increasingly available, allowing traders to make decisions based on real-time market data.

- Edge Trading: The emergence of edge trading platforms will allow traders to execute trades at the optimal time, leveraging AI’s ability to analyze market conditions.

Conclusion

AI has transformed cryptocurrency trading, providing a range of benefits including improved market timing, better risk management, and increased efficiency. While challenges such as data quality and bias in training data remain, the future of AI in cryptocurrency trading is very promising. As we continue to advance our understanding of machine learning and its applications in finance, we can expect to see even more innovative tools emerge that will enable traders to succeed in this complex and rapidly evolving market.

Sources:

- Binance’s A.I.