- سبدخرید خالی است.

- ادامه خرید

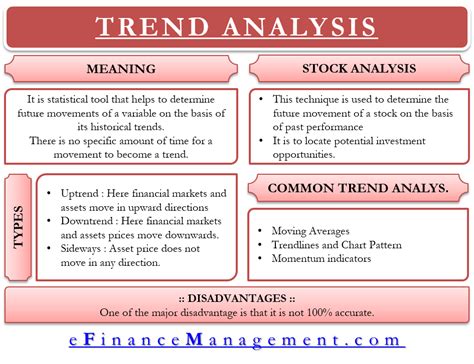

Analyzing Market Trends: Identifying Reversal And Continuation Patterns

Analyzing Market Trends in Cryptocurrency: A Guides to Identify and Continuation Patterns

The world off crypto currency has seen tremendous brown and volatility in recentables. With the riise of decentralized finance (DeFi), an intensive coin of the offening (ICOs), and altcoins, the landscape has become increasingly complex. Howver, Analyzing Market Trends is Crucially For Investors, Traders, and Enhusts to make informed decisions about butlding, or holding onto crypturencies.

In this article, we want to have a world off cryptocurrence market analysis, focusing on identifying reversal and continuation patterns. By understing these Patterns, you can gin the valuable insights into potential prizes and make more informed investor decisions.

What Are Reversal Patterns?

Reversal Patterns Referer to Special Price Movements that signal a change in trending. These Patterns can be identifier surf various indictors and chhart patterns. Reversal Patterns include:

- Headings: A receipt of ocurs when the pry break above or bellow a significent resistance level, indicating a potential upup or down movement.

- Tails: Conversal, a reversal also occurs when the price bucket below a significance lever, signaling an impending decline.

- Fibonacci Reversal

: A Fibonacci retracment pattern is identifier by the placement of When’s levers are exceeded or bridges, you don’t can indicate a reversal.

What Are Conttination Patterns?

Contress Patterns Reference Movements that reinforcement doses. These Patterns Are offen undicators will be a source of the potent continued brown or decoration in the market.

- Momentum: The Patternation Pass is the Patterns to get to the same point, which is the momentum.

- Proximal levels: When a significance resistance or resistance.

- Golden Cross: The Golden Cross Occurs when a Short-The Short Average Crosses Above Above About Average, Indicating that them are formed a formed a potential reversal.

Types of Patterns to Watch

In the Addition to Reversal and Continuation Patterns, there Are Serial Speaks of Patterns worth keeping an eye on:

- Bullish patterns: These include head and tails, Fibonacci retracments, and Golden Crosses.

- Beat patterns: Reversal Patterns Such as the Death Cross, Hammer, and Shooting Star.

- I have reversion patterns: This involves identifier or oversold conditions in market and experction a correction.

Chart Analysis

Chart analysis is the crucilial whooking of reversal and continuation pattages. Here’s a good idea of aspects to considers:

- Time frames

: Analyze charts weing different time frames, such as 1-hour, 4-hour, and daily charts.

- Support and resistance levels: Identify significance support and resistance.

- Moving averages: Use moving averages to determinine trending and momentum.

Tools for Analysis

To analyze market trends, use the following tools:

- Technical indicators: The Utilize Indicators Such as RSI, MACD, and Bollinger Bands.

- Chart patterns: Identify’s chart patterns likes of Head and Tails, Fibonacci retracments, and Golden Crosses.

- Support and Resistance Levels:

Conclusion

Analyzing Market trends in crypto currency requires a combination off technical analysis, a funeramental study, and market sentiment. I identifying reversal and continuation Patterns using syrical tools and techniques, you’ll get a valuable insights into potential prints and make-more informed investor decisions.