- سبدخرید خالی است.

- ادامه خرید

Ethereum: What prevents Bitcoins for being used to avoid taxation?

Title: Ethereum: What Prevents Bitcoins from Being Used to Avoid Taxation?

Introduction

The rise of cryptocurrencies like Bitcoin has been driven in part by their potential to provide a decentralized alternative to traditional financial systems. One of the most significant benefits of using cryptocurrencies is that they offer a level of anonymity and security that makes it difficult for governments to track transactions and identify individuals involved in illicit activities. However, despite these advantages, many people still attempt to use cryptocurrencies to avoid taxation. In this article, we’ll explore why Bitcoin is not a viable option for evading taxes and what prevents its use.

Why Bitcoin can’t be used to avoid taxation

One of the main reasons why Bitcoin cannot be used to avoid taxation is that governments have implemented various measures to track transactions and monitor financial activity. For example:

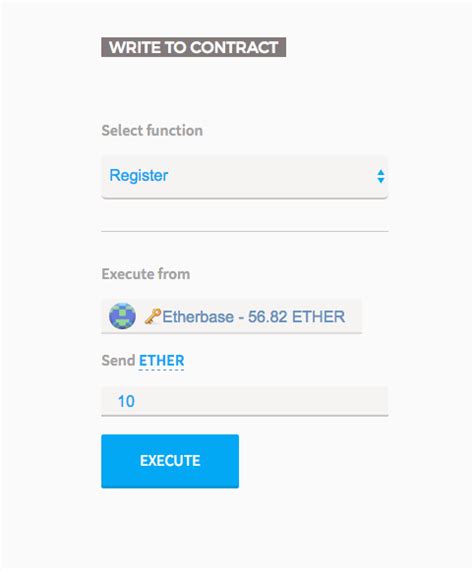

- Blockchain analysis: The Ethereum blockchain, which is a distributed ledger technology behind many cryptocurrencies, can be analyzed to identify patterns and connections between individuals and businesses.

- Tax reporting: Many countries require tax authorities to report financial transactions, making it difficult for individuals to hide their income from taxes.

- Regulatory frameworks: Governments have established regulatory frameworks that prohibit the use of cryptocurrencies for illicit activities, such as money laundering and terrorist financing.

Bank account tracking

Another key aspect is the ability to track bank accounts. Many banks provide detailed transaction histories and records of customer activity, which can be used by tax authorities to identify individuals involved in cryptocurrency transactions.

The limitations of Bitcoin transactions

Bitcoin transactions are pseudonymous, meaning that they do not reveal an individual’s or business’s identity. However, this also means that it is impossible for anyone else to read your Bitcoin transactions and identify you or your business without your consent. Additionally, Bitcoin transaction fees can be high, which may make it more difficult for individuals to use cryptocurrencies to avoid taxes.

Conclusion

While cryptocurrencies like Bitcoin offer a level of anonymity and security that makes them appealing to some individuals, they are not a viable option for evading taxation. Governments have implemented various measures to track transactions and monitor financial activity, making it difficult for individuals to hide their income from taxes. As the use of cryptocurrencies continues to grow, it is essential to understand the laws and regulations surrounding their use in order to stay compliant with tax authorities.

Additional Resources

- [Cryptocurrency Taxation Laws](

- [Ethereum Tax Laws](

- [Bitcoin Tax Laws](