- سبدخرید خالی است.

- ادامه خرید

Fundamental Valuation: Assessing The True Value Of Cryptos

Cryptocurrency: basic assessment – Evaluation of the true value of crypto

The cryptocurrency market was known for its volatility and unpredictability. With the growth of Bitcoin, Ethereum and other altcoins, investors have poured millions of digital devices in the hope they would make a quick profit. However, before investing or buying in cryptocurrencies, it is essential to assess their basic value. In this article, we are immersed in the concept of fundamental evaluation and examine how this applies to cryptocurrencies.

What is the basic assessment?

The basic assessment is an analytical approach that focuses on economic foundations on the basis of the cryptocurrency, such as market capitalization, revenue sources, user base, adoption rate and technical standards. It helps investors understand whether the asset is undervalued or overestimated based on these basic indicators.

The traditional evaluation method

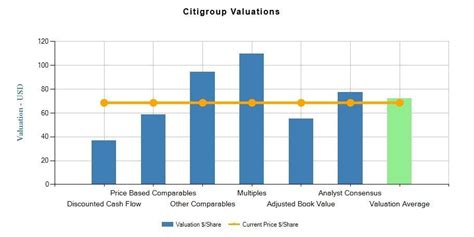

Traditional financial markets rely heavily on evaluation rates, such as the price income (P/E) ratio to determine the value of the asset. For example, if a company’s market capitalization generates $ 100 billion and generates $ 10 billion in revenue, your P/E ratio would be 1000. This means that investors are willing to pay $ 1 for every dollar. However, this approach does not exactly reflect the true value of the device.

The unique properties of cryptocurrency

Unlike traditional tools, cryptocurrencies have unique features that are more challenging for analysis of conventional assessment methods:

* Liquidity : Cryptocurrencies have extremely high liquidity, allowing investors to quickly buy and sell them. This liquidity can lead to rapid price fluctuations, making it difficult to determine the value of the device.

* Voatity : Cryptocurrency prices are notoriously volatile, and daily prices often exceed 10-20% in a day. This volatility questions future performance and value prediction.

* Limited Care : Most cryptocurrencies have limited benefits, which can lead to scarcity and increase demand.

A fundamental evaluation of main cryptocurrencies

Examine the basic assessment of some major cryptocurrency:

* Bitcoin (BTC) : Bitcoin is the largest cryptocurrency with a trillion market capitalization. Revenue sources include miners’ transaction fees and transaction quantity.

+ Ratio of Price Income: About 30,000

+ Market capitalization: over 2 trillion dollars

* EThereum (ETH) : As one of the most widely marketed cryptocurrencies, Ethereum has a strong user base and significant sources of revenue through transaction fees and smart contracts.

+ Price market ratio: about 20,000

+ Market capitalization: over $ 150 billion

* Litecoin (LTC) : With a market capitalization of about $ 10 billion, Litecoin is a popular alternative to bitcoin. The sources of revenue include the installation of miners’ transaction fees and smart contracts.

+ Price income ratio: approximately 1000

Conclusion

Although conventional assessment methods can provide insight into the value of a device, they may not exactly reflect the true value of cryptocurrencies. The basic assessment offers a more comprehensive approach to the basic economic foundations of the cryptocurrency.

Investors should consider the following when evaluating basic assessments:

* Market Capitalization : Higher market capitalization often indicates higher liquidity and reduced volatility.

* Revenue Sources : Cryptocurrencies can be more valuable with significant sources of revenue, transaction fees, installation of smart contracts or other resources than such sources of revenue.

* User Base : A strong user base can increase demand and price for cryptocurrency.