- سبدخرید خالی است.

- ادامه خرید

How Governance Tokens Influence The Trading Of Stellar (XLM)

The Role of Governance Tokens in Shaping the Stellar (XLM) Trading Market

In recent years, blockchain technology has revolutionized the world of finance and beyond. Cryptocurrencies like Bitcoin, Ethereum, and Litecoin have set the standard for decentralized applications and trading platforms. However, one cryptocurrency that stands out from the rest is Stellar (XLM). As a fast and secure digital asset, Stellar has gained immense popularity among traders and investors worldwide. In this article, we will explore how governance tokens influence the trading of Stellar XLM.

What are Governance Tokens?

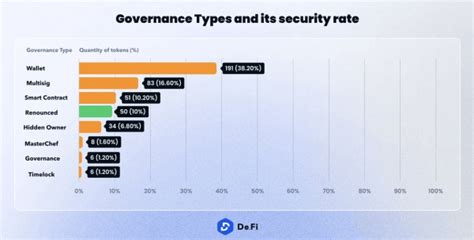

Governance tokens are non-fungible tokens that represent ownership in a blockchain project or organization. They are designed to give holders voting power and decision-making authority over the project’s operations, such as proposing new features, electing administrators, and setting regulatory guidelines. In other words, governance tokens enable token owners to participate in shaping the direction of their assets.

Stellar (XLM) Trading Market

The Stellar ecosystem is a decentralized exchange (DEX) that enables peer-to-peer trading across multiple blockchain networks. As one of the largest DEXs on the market, Stellar provides access to over 500 trading pairs and supports fast, secure, and low-cost transactions. The XLM/USD trading pair is particularly popular among traders, with prices fluctuating rapidly due to market sentiment.

The Role of Governance Tokens in XLM Trading

Governance tokens play a crucial role in shaping the XLM trading market by:

- Amplifying Voting Power

: Governance tokens give holders voting power and decision-making authority over Stellar’s operations. This enables them to participate in strategic decisions, such as proposing new features or electing administrators.

- Regulating Market Sentiment: By allowing token owners to vote on regulatory proposals, governance tokens can influence market sentiment and impact the trading prices of XLM.

- Improving Transparency: Governance tokens promote transparency by providing a clear understanding of voting power distribution, asset allocation, and decision-making processes.

The Case for XLM Governance Tokens

Several factors contribute to the popularity of XLM governance tokens:

- Security: Stellar’s decentralized architecture and open-source nature make it an attractive platform for security-conscious investors.

- Community Building: The Stellar community is known for its active participation and engagement, fostering a strong sense of ownership among token holders.

- Adoption by Institutional Investors: As institutional investors increasingly explore alternative cryptocurrencies like XLM, the demand for governance tokens has increased.

Notable Governance Token Examples

Several notable governance tokens have been introduced in the Stellar ecosystem:

- Stellar Development Foundation (SDF): This governance token represents a significant portion of the project’s development budget and voting power.

- XLM Governing Council: The XLM Governing Council is responsible for proposing new features, electing administrators, and setting regulatory guidelines.

Conclusion

In conclusion, governance tokens play a vital role in shaping the Stellar (XLM) trading market by amplifying voting power, regulating market sentiment, and promoting transparency. As institutional investors increasingly explore alternative cryptocurrencies like XLM, the demand for governance tokens has increased. By understanding how governance tokens influence the trading of Stellar XLM, traders and investors can better navigate this rapidly evolving landscape.

Disclaimer

This article is for informational purposes only and should not be considered as investment advice.