- سبدخرید خالی است.

- ادامه خرید

How To Utilize Trading Indicators For Shiba Inu (SHIB) Investments

How to Utilize Trading Indicators for Shiba Inu (SHIB) Investments

The world of cryptocurrency and trading has evolved significantly over the years, with numerous indicators available to help investors make informed decisions. Among these indicators are specialized technical analysis tools that focus on specific cryptocurrencies like Shiba Inu (SHIB). One such indicator is the Moving Average Convergence Divergence (MACD), which is widely used in various markets, including cryptocurrency trading.

What is MACD?

The MACD is a popular technical indicator developed by George C. Lane. It is designed to display two moving averages: one with a 12-period weighted average and the other with a 26-period weighted average. The MACD line plots the difference between these two moving averages, creating a line that oscillates between positive and negative values.

Here’s a breakdown of the MACD indicator:

- The short-term moving average (SMA-12) is plotted on the chart as the blue line.

- The long-term moving average (SMA-26) is plotted on the chart as the red line.

- The MACD line consists of two lines: the signal line (red line with a 9-period EMA) and the histogram line.

How to Utilize MACD for Shiba Inu (SHIB) Investments

To utilize MACD for SHIB investments, follow these steps:

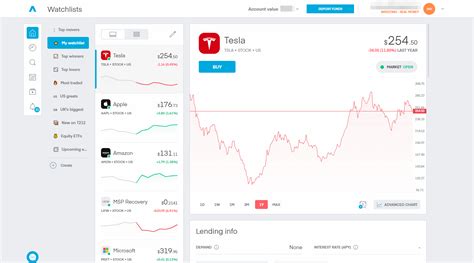

- Choose a Trading Platform: Select a reputable trading platform that offers the necessary tools to work with technical analysis indicators like MACD.

- Load the Shiba Inu Price Chart: Load the price chart of SHIB on your chosen trading platform.

- Select the MACD Indicator: Choose the MACD indicator and configure it according to your needs. A common setup is to use a 9-period EMA for the signal line and a 26-period EMA for the histogram line.

- Plot the Indicators: Plot the MACD lines on your chart, ensuring they are visible but not overlapping with other indicators.

- Calculate the MACD Signal Line: Calculate the MACD signal line by subtracting the short-term SMA from the long-term SMA (Signal Line = Short-Term SMA – Long-Term SMA).

- Identify Bearish and Bullish Signals: Use the MACD indicator to identify bearish and bullish signals:

* A negative MACD signal indicates a potential sell or bearish signal.

* A positive MACD signal indicates a potential buy or bullish signal.

Bearish Signals:

- A short-term MACD signal line is below the long-term SMA ( Bearish Signal).

- The MACD histogram line crosses above the signal line ( Bullish Signal).

Bullish Signals:

- A short-term MACD signal line is above the long-term SMA ( Bullish Signal).

- The MACD histogram line crosses below the signal line (Bearish Signal).

Tips and Considerations

- Adjust Indicator Settings: Adjust the indicator settings to optimize the performance of the MACD.

- Use a Range Bound Strategy: Use a range bound strategy with MACD, taking advantage of its ability to provide early warning signals for potential price movements.

- Combine with Other Indicators: Combine MACD with other technical indicators like RSI, Bollinger Bands, or Stochastic Oscillator to create a more comprehensive trading strategy.

Conclusion

The MACD indicator is a powerful tool for Shiba Inu (SHIB) investors, offering early warning signals and helping to identify potential price movements. By following these steps and tips, you can utilize the MACD for informed trading decisions on this cryptocurrency market. Remember to always trade responsibly and within your means.

Disclaimer: This article is for informational purposes only and should not be considered as investment advice. It’s essential to do your own research, set stop-losses, and never invest more than you can afford to lose.