- سبدخرید خالی است.

- ادامه خرید

IDO, Candlestick Chart, Profit

The Rise of Cryptocurrencies and the Power of Candlestick Charts: A Guide to Unlocking Profits in the Market

As the world becomes increasingly digital, cryptocurrencies have become a revolutionary force that is changing the way we think about investing. With thousands of cryptocurrencies available, investors are constantly looking for new ways to maximize their returns while minimizing risk. One popular strategy to achieve this goal is initial distribution offering (IDO), where investors band together to buy and hold a single token on an exchange. However, before investing in any cryptocurrency, it is essential to understand the basics of IDO and how candlestick charts can help you make informed decisions.

What is IDO?

IDO stands for Initial Diversification, which refers to the practice of pooling the investments of multiple individuals or entities into a single investment vehicle. This allows investors to share the risks and rewards of their holdings while spreading their risk across a broader range of assets. In the context of cryptocurrencies, IDO involves buying and holding a token on an exchange in order to diversify your portfolio.

Candlestick Charts: A Powerful Tool for Investors

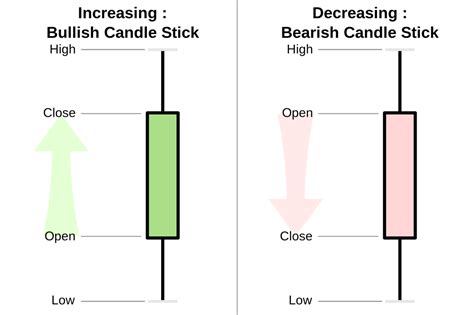

Candlestick charts are a fundamental tool used by investors to analyze market trends and patterns. By visualizing price movements over time, candlestick charts allow traders to identify potential trading opportunities and adjust their strategies accordingly. In the context of cryptocurrencies, candlestick charts can be particularly useful for identifying profit potential.

Here’s how candlestick charts can help with IDO:

- Identifying Trendlines: Candlestick charts allow investors to visualize the direction of a trend over time. By analyzing the shape and pattern of candlesticks, traders can identify whether the market is moving up or down.

- Recognizing Patterns: Different types of candlesticks (e.g. hammer, shooting star, doji) offer valuable clues about market behavior. Traders who understand these patterns can anticipate future price movements and adjust their strategies accordingly.

- Monitoring Volume and Activity: By looking at the volume and activity on a candlestick chart, traders can gain insight into market sentiment and identify potential trading opportunities.

How to Use Candlestick Charts for IDO

To effectively use candlestick charts for IDO, follow these steps:

- Choose a Reliable Exchange:

Select an exchange that offers competitive fees, reliable trading conditions, and access to the full range of cryptocurrencies.

- Select a token: Choose a token that you believe has high growth potential or is likely to be in high demand in the coming weeks.

- Buy and hold: Buy as much of your chosen token on the exchange as possible and then hold it for an extended period of time. The longer you hold your investment, the more time you have to ride out market fluctuations and potentially benefit from higher prices.

- Monitor your chart: Check your candlestick chart regularly for any changes in market behavior or potential trading opportunities.

Tips for maximizing profits with candlestick charts

To maximize profits using candlestick charts for IDOs, consider the following tips:

- Focus on high leverage trades: Long-term trades require a large amount of capital. Focus on high leverage trades that can help you ride out market fluctuations and potentially benefit from higher prices.

- Use multiple time frames: Analyze your chart with different time frames (e.g. 1 hour, 4 hour, daily) to get a more complete understanding of market behavior.

- Don’t overtrade:

Avoid overtrading by focusing on long-term strategies and adjusting your approach as needed.