- سبدخرید خالی است.

- ادامه خرید

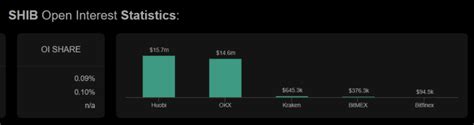

OKX, Whale, Open Interest

Cryptocurrency growth: understanding okx, whales and open interest

In the world of cryptocurrency, few terms are as noisy as “whale” or “open interest”. For those who are not familiar with these concepts, here is a comprehensive guide to understanding what it means:

What is an exchange of cryptocurrency okex (okex)?

Okex (former Global OSL) is a popular cryptocurrency exchange that facilitates the purchase, sale and trading of different cryptocurrencies. Founded in 2011 by Changpeng Zhao, the exchange has become one of the largest and most famous platforms for digital foreign currency trading.

What is okx doing?

As a exchange of cryptocurrency, Okex offers users a safe and reliable platform to buy, sell and store cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Binance Coin (BNB) and many more. The exchange also offers various tools and features such as:

- Trading pair: Okex accepts trading in over 2,000 cryptocurrencies.

- Market depth: The exchange provides real -time price quotations and market data to help users make the knowledge of the case.

- Liquidities Groups: Okex has a robust liquidity system, ensuring that prices are stable and accessible to users.

- Derivative instrument support: Okex offers options, futures and other derivative products.

Who is a “whale okx”?

A “OKX whale” refers to a significant investor or trader who has a large amount of cryptocurrency on the platform. These whales can influence market trends by buying or selling large amounts of assets, creating liquidity or disrupting price movements.

The term “whale” was invented in 2017 by Tom Lee, the founder founded Global Advisors, after a $ 1 million trading order from an anonymous investor (later revealed to be an Okex user) disturbed the Ethereum (ETH) price. This incident highlighted the potential of large investors to impact on market prices and aroused increased examination on cryptocurrency exchanges.

open interest: a measure of market depth

The open interest is a statistical measure that represents the total number of outstanding contracts or instruments derived on a certain market, including futures, options and other derivative products. Provides a perspective on market size and liquidity.

When the open interest is high, it usually indicates a healthy market, with a proper trading activity. In contrast, low open interest can signal the market stress, as fewer traders participate in the market.

Why is the interest open?

Open interest is essential for understanding the dynamics of cryptocurrency markets:

* The depth of the market: The open interest helps to maintain the stability and liquidity of the market.

* The liquidity disposition: The open interest provides a reference point for the value of the assets available for trading, which affects the market prices.

* Trading volume:

A large open interest can increase trading volumes, increased market participation and activity.

Why are important whales?

Whales play a crucial role in modeling cryptocurrency markets by:

* Setting market trends: Large traders can influence price movements by buying or selling large amounts of assets.

* Creating liquidity: Whale helps maintain depth and market stability, providing the platform liquidity.

* Influence of regulatory attention: Whale actions can arouse regulatory interest, as government bodies can investigate their activities.

Conclusion:

Okex, the activity of whales and open interest are crucial components of the cryptocurrency landscape. As the digital currency ecosystem continues to evolve, understanding these concepts will help investors, traders and market participants to sail in the complex world of cryptocurrency markets.