- سبدخرید خالی است.

- ادامه خرید

Rekt, Public key, Risk management

“The Wild West of Risks: Understanding the Risks and Strategies of Cryptocurrency Trading”

The world of cryptocurrency has come a long way since its inception in 2009. Once considered the “Wild West” of finance, the market has evolved into a sophisticated marketplace with a wide range of trading strategies, innovative technologies, and cutting-edge risk management techniques. . However, as with any high-risk endeavor, there are risks that traders should be aware of when trading cryptocurrencies.

What is crypto?

A cryptocurrency refers to a digital or virtual currency that uses encryption to secure financial transactions. The most well-known cryptocurrency is Bitcoin (BTC), which was launched in 2009 and has since become the largest and most widely used cryptocurrency. Other notable cryptocurrencies include Ethereum (ETH), Litecoin (LTC), and Ripple (XRP).

Rekt: Cryptocurrency Trading Disaster

Rekt refers to a phenomenon that occurs when a trader’s investment is wiped out due to market volatility, lack of liquidity, or poor risk management. Rekt is a slang term used to describe the consequences of trading cryptocurrencies recklessly without proper research, analysis, or risk management strategies.

The Rekt incident at Mt. Gox, one of the largest cryptocurrency exchanges, is a prime example of this concept. In 2014, Mt. Gox was hacked, causing huge losses to investors. The hack led to a massive sell-off of Bitcoin and other cryptocurrencies, wiping out millions of dollars worth of investments.

Public Key: Cryptographic Technique

A public key is a mathematical function that allows users to encrypt messages or data using their private key. In the context of cryptocurrency trading, a public key refers to a unique address associated with a wallet on the blockchain network. When a trader wants to transfer money from one wallet to another, they must use their public key to authenticate and authorize the transaction.

Risk Management: The Key to Success

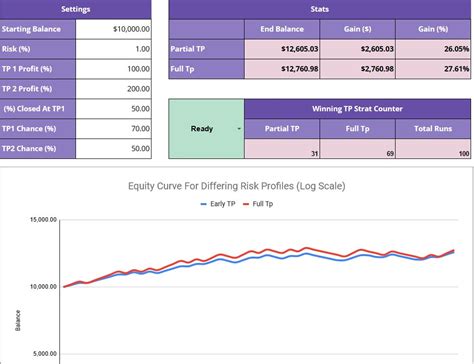

Risk management is a critical component of successful cryptocurrency trading. It involves identifying potential risks, assessing their likelihood and impact, and implementing strategies to mitigate them. Risk management can be applied to various aspects of trading, including market volatility, liquidity, regulatory changes, and security breaches.

Effective risk management techniques include:

- Diversification: Spreading investments across multiple assets to minimize exposure to a single market or asset.

- Position Sizing: Setting realistic investment amounts per trade to avoid significant losses from a single bad trade.

- Stop-loss orders: Implement automatic stop-loss limits to limit potential losses in the event that the trade does not reach the desired price.

- Liquidity analysis: Evaluate the availability and accessibility of trading pairs, markets, and exchanges to ensure adequate liquidity.

In summary, cryptocurrency trading is a high-risk venture that requires careful consideration of risks and strategies. By understanding the concept of Rekt, the importance of public keys, and implementing effective risk management techniques, traders can minimize their losses and maximize their returns in this rapidly evolving market. As the cryptocurrency landscape continues to evolve, it will be essential for traders to stay informed and tailor their strategies accordingly.