- سبدخرید خالی است.

- ادامه خرید

Setting Up Stop Orders For Risk Management

Setting up orders for cryptocurrency risk management

In the area, cryptocurrencies, which are highly volatile, may experience rapid price fluctuations, which can cause significant losses if they are not properly managed. One effective way to reduce these risks is to set the suspension orders. In this article,

** What are stopping orders?

The amount of security that can be sold or bought. The aim of the stopping order is to limit possible losses if the market is moving towards you. When the stop order is activated;

Stopping orders setup in cryptocurrency

Cryptocurrency, follow these steps:

1. Choose and Cryptocurrency Exchange

Cryptocurrency cryptocurrency exchange where you want to buy and sell your cryptocurrency. Some popular exchanges include Coinbase, Binance and Kraken.

2. Open the account

Once you have chosen the exchange, open the account for them, providing personal and financial information.

3. Fund your account

You will have to finance with cryptocurrency

4. Set stop orders

Once your account is funded, take these steps to create an interruption orders:

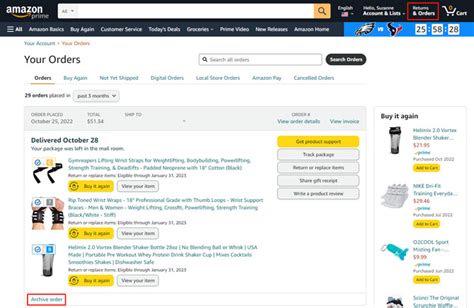

- Log in to your Exchange account and go to the “Order” tab.

- Click “Stop Order” and select “New”.

- Enter the following information:

+ Symbol: The cryptocurrency symbol you want to buy or sell (eg BTC/USDT).

+ Quantity: The amount of cryptocurrency you want to market (eg 0.1 BTC).

+ Price: The price you are willing to set the suspension order (for example, $ 50,000).

- Set the “stop loss” level, which is the price for which your suspension order will be activated if the market is moving towards you.

Example:

- Symbol: BTC/USDT

- Quantity: 0.1 BTC

- Price: $ 50,000

- Stop Loss: $ 45,000

5. Set and get a profit

To set the profit level, enter another price you will terminate your order will be activated if the market moves in your favor.

Example:

- Symbol: BTC/USDT

- Quantity: 0.1 BTC

- Price: $ 50,000

- Stop Loss: $ 45,000

- Take a profit level: $ 55,000

6. Review and confirm your orders

In the area

Benefits by creating orders for risk management in cryptocurrency

Setting up orders can help manage cryptocurrency risk:

- Restricting possible losses if the market is moving toward you

- Let you lock the profit if the market moves in your favor

- Provision of security network at high market volatility

Conclusion

Setting up risk management orders is an effective way to submit their actions described above and consider marks for you.

Additional tips

- Always study

*

In the area