- سبدخرید خالی است.

- ادامه خرید

Systemic Risk In Decentralised Finance: What To Know

Systemic risk in decentralized funding: Understand threats

Dentralized Finance (Defi) has revolutionized the financial industry by providing a new platform for people and institutions to use a wide range of financial products and services. However, like any system, Defi is not an immune to systemic risk. This article deepens the world of a decentralized economy and explores the risks defined by the global economy.

What is a systemic risk?

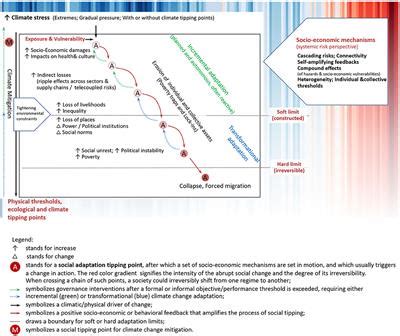

Systemic risk refers to the potential of a major financial crisis or economic recession with long and devastating consequences. It means a chain reaction of events, which can lead to the collapse of the entire system, causing general instability and possibly triggered panic in a wider market.

Distributed Financing: Landscape Defi

Defi is a decentralized ecosystem based on Blockchain technology that enables peer stores without the need for brokers, such as banks. Defi protocols, such as loan platforms, exchanges and performance agricultural systems, have created new opportunities for financial innovation. However, this decentralization also means that the defi is not subject to the same regulatory framework or risk management practices as traditional financial systems.

Risks associated with defi

Defi involves several risks, including:

- Liquidity Risks : Protocols often work in thin liquidity wires, which makes it difficult for users to cancel their funds at the desired speed.

- Safety Risks : As with any decentralized platform, there is a natural risk of security offenses or piracy attacks, which can lead to significant financial losses.

- Risks of the line : Protocols often use large lever effects, allowing users to borrow and invest large amounts of money with relatively small deposits. This increases the risk of significant losses if the market decreases.

- Volatility Risks : Encryption currencies are known for its volatility, which can lead to rapid prices that can be difficult to predict or control.

- Risk Risks : As Defi continues to gain popularity, regulatory frames are likely to change and are not consistent with the decentralized nature of these protocols.

Systemic risk: threat to global stability

The risks associated with Defi are significant and can be a threat to global stability. The potential of a systemic crisis in Defi may have long consequences that include:

- Credit crisis : If an important protocol violated their loans or duties, it may trigger a credit crisis that would affect the entire financial system.

- Market Decision : A sudden and general loss of trust in the defi protocol can lead to market downturn, as investors lose faith in the safety and stability of these platforms.

- Economic Contracting : A systemic crisis in the defi can lead to a decline in financial activity, as companies and people are more cautious about investing in new financial products.

Systemic risk relief: What can be done?

Although systemic risk is natural for the Defi, measures may be taken to alleviate these risks:

- Regulatory Framework : Government and regulatory bodies must develop clear instructions and framework for the defi protocol, ensuring that they operate within established regulations.

- Risk Management Policy : Financial institutions and Defi protocols must implement solid risk management practices, including diversification, coverage and loss of loss of loss.

- Providing Liquidity : Central banks and financial institutions must provide sufficient liquidity to the minutes to help the market stabilize the market in the case of a crisis.

4.