- سبدخرید خالی است.

- ادامه خرید

The Impact Of Price Action On Market Sentiment In Crypto Trading

Effect of prices on market moods on cryptocurrency trade

The cryptocurrency has been a hot topic for several years in the financial world, with an excellent price that goes between heights and the lowest. In this article, we will examine how the cryptocurrency price can affect market mood in the cryptocurrency trade.

What is the action of the price?

Price action means effective movement of the safety price over time. This is a daily or minute fluctuation of actions or value value. This type of data is necessary for merchants and investors to make reasonable decisions on the purchase, sale and storage cryptocurrency.

MARKET MOOD

The market moods mean the investor’s emotions and opinions on the general management of the market. This can be influenced by various factors such as economic indicators, news events and social media sounds. When the mood of the market changes, it often reflects the trust of a trader or an investor with their investment or their desire to take risks.

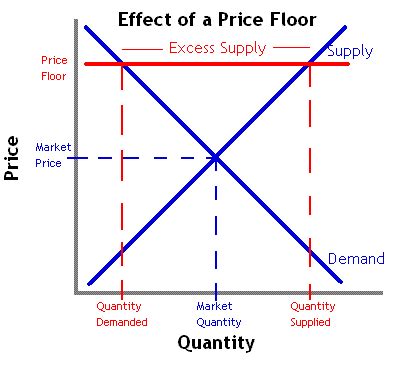

Effect of prices on the mood of the market

Price phases have a remarkable impact on market moods on cryptocurrency trade. Here are several ways for how the price action can affect the mood of the market:

- If the price movement satisfies their expectations, it improves their trust in themselves and increases potential profits.

- This can increase sales pressure and reduce market mood. On the other hand, if the price action is high (high), it can promote the purchase pressure and increase the mood of the market.

- Risk tolerance : Price action can also affect risk tolerance. If the traders feel comfortable with a certain risk of cryptocurrency, they may have more likely to obtain a position or to maintain their positions for a longer period of time.

- Mercato Movers : The price of some cryptocurrencies such as Bitcoin Ethereum has historically influenced the external factors as economic indicators, news events and bustle of social media.

Basic price indicators

Numerous basic price indicators can help merchants and investors understand the mood of the market in the cryptocurrency trade. This includes:

1

- Bollinger bands : Bollinger bands provide a volatility indicator and can be used to set areas where market moods are likely to change.

3

- Move media

: Movement Averages such as 50 periods and 200 periods of movement can mean market moods by providing the base for comparison with current price changes.

Examples of cryptocurrency with unique price models

Some cryptocurrencies have unique price models that can provide information on their potential impact on market moods. For example:

1

2.

Conclusion

The impact of market prices on cryptocurrency trade is complex and multifaceted.