- سبدخرید خالی است.

- ادامه خرید

The Role Of Bridges In Cross-Chain Transactions

The role of bridges in cross -transactions

The increase in cryptocurrencies has revolutionized the way people and organizations carry out transactions. With the arrival of Blockchain technology, people can store, check and send value without counting on brokers such as banks or payment processors. However, this transparency and increased control have a significant disadvantage: cross -transactions.

In traditional financial systems, when you want to transfer funds from one account to another, you must often go through an intermediary – a bank. This can lead to high costs, slow processing times and limited availability. Cryptocurrencies have resolved these fears by introducing decentralized systems that allow fast, safe and inexpensive transactions in various blockchain networks.

However, there is an increasing need for more effective solutions, in particular with regard to international transactions and asset transfers. Crossed transactions are one of the areas where restrictions on traditional payment systems become visible. They include the transfer of resources or values from one blockchain network to another, often using bridges connecting these distinct ecosystems.

What are the bridges?

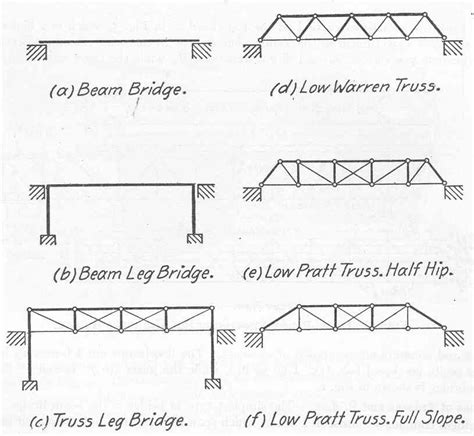

The bridge is a software layer that allows gentle interaction between different blockchain networks. It acts as an intermediary between the source and target blocks, facilitating the transfer of assets above borders without prejudice to security or decentralization. Bridges generally include several components:

- Integration of the decentralized application (DAPP) : A personalized application that affects many blockchain protocols.

- Integration of the API : Safety API interfaces which allow DAP to communicate with bridges and other networks.

- Drawing of the Blockchain of the Protocol : the bridge itself, which allows communication between different blockchain networks.

Challenges related to chain transactions

Although bridges can revolutionize transactions between the chain, they are also with several challenges:

- Evolution problems : High overload of the network can result in the slowdown in transactions treatment and the increase in costs.

- Security risk : The absence of a control point makes data insurance and the integrity of security difficult.

- Interoperability restrictions : Different blockchain networks can have different standards for certain functions, which leads to compatibility problems.

Advantages of bridges in cross -transactions

Despite these challenges, the bridges acquire membership in the cryptocurrency space:

- Improvement of scalability : Bridges can increase the capacity of the network, allowing many transactions per second.

- Increased safety : Uselessly unnecessary connections, bridges can provide higher levels of protection and data integrity.

- Increased interoperability : The bridges allow a smooth interaction between different blockchain networks, reducing barriers to the adoption of the transverse chain.

Applications in the real world

Bridges are used in various applications in the real world, in particular:

- Crossed payments : Most international payment systems allow faster and cheaper transactions for natural and businesses.

- Transfer of resources : Cryptocurrencies can be moved between different blockchain networks using bridges to facilitate the movement of assets above borders.

- Decentralized finances (DEFI) : Mosy play a key role in DEFS facilitation, which includes cross -transactions.

Application

The role of bridges in cross-transactions is multi-face and develops quickly. As the cryptocurrency landscape increase, we can expect more innovative solutions to appear.